When you contract a professional commercial debt collection agency to help you recover outstanding receivables, you would want to make sure that they are successful at helping you get paid as quickly as possible.

Therefore, you must hire an agency with extensive experience and understanding of the techniques and methods that operate in the debt recovery process. One important thing collectors should know is which questions to stop and which questions to pursue while dealing with debtors.

Don’t let the Debtors determine the circumstance

So many debt collectors are attempting to get the debtors to comply merely by being polite and kind. In so many situations, it means telling the debtor what fits for them. However, this minimizes the collector’s assurance and allows the debtor a sense of power in the situation. For instance:

“When are you going to make a payment?”

This issue places the ball in the debtor ‘s hands and will make them believe that they have the right to impose a payment plan or timetable.

“Have you sent a payment already?”

It lets the debtor know that you are now awaiting a deposit. In addition, it is not an open-ended question that grants a debtor ‘s authorization to have a dialogue.

If the debtor replies that they have not sent a payment, hold a payment on the case by telling them to send it that day. Please make clear the hopes that the repayment will take effect right away, and not until it better suits the debtor.

This gives the collector an aura of power which self-assurance, which continues the dialogue toward a meaningful outcome instead of a continued negotiation of schedules.

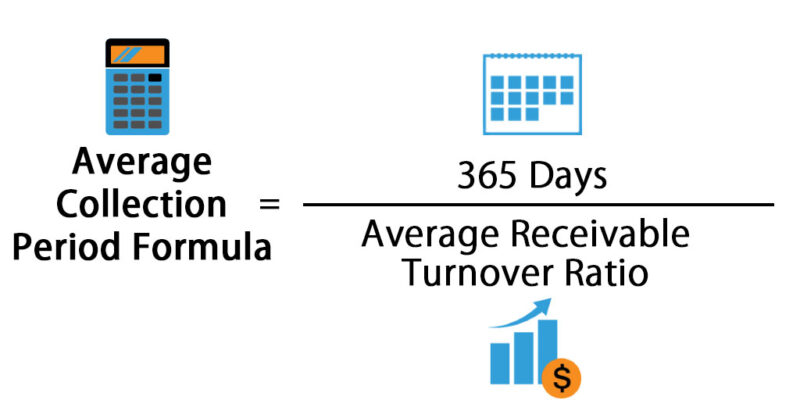

Calculate your average collection period

It’s important to ask the right questions and avoid the wrong ones in the collections. However, even though you ask the right questions, you can obtain assurances that will be broken later.

It is important to follow up on broken promises in a timely way and these correspondence can also be prioritized, since some progress has been made in the settlement process for this particular debtor.