Every business faces unique challenges to its collections side. Companies operating mainly on business-to – business transactions often encounter different obstacles when it comes to maintaining profitability.

Whether you run a small business or a Fortune 500 company, it is essential to adopt different strategies to ensure that your accounts receivable are well managed and that you receive consistent payments from your customers.

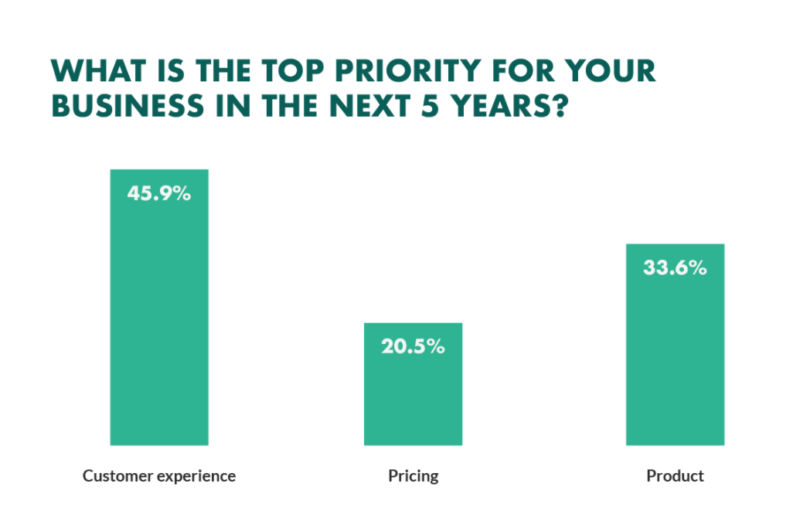

The Temkin Group found that companies that earn $1 billion annually can expect to earn, on average, an additional $700 million within 3 years of investing in customer experience.

37 CUSTOMER EXPERIENCE STATISTICS YOU NEED TO KNOW FOR 2021 | Toma Kulbytė

Maintain a good relationship with your customers

It’s one of the most critical aspects in creating a profitable market. Maintaining regular contact and engagement with the customers will help make payments smoother and avoid non-payment.

Establish specific billing & collection policies

Making sure that the accounts receivable department has a straightforward process for receiving payments will have a dramatic effect on your bottom line. Check with the team to set up recovery plans for what happens immediately after a sale occurs, when payment is due, and when the account becomes overdue.

Make statements and invoices easy to comprehend

Clearly outline the products and services provided — avoid the use of specific abbreviations and jargon. This information helps you build a more straightforward invoicing method which allows the clients a simple description on what is expected from them.

Set up payment schemes

For many clients, the payment plans can reduce the burden on their businesses while providing you with consistent cash flow for your services. Receiving a lump sum payment is preferable, but providing your clients with flexible payment plans can strengthen your relationship with your clients and ensure that each account is paid in full.